THE ASYMMETRY OF

GAINS AND LOSSES

Preprogrammed Examples

Why Recovering from Losses Takes More Than You Think

In the world of finance and psychology, few ideas are as deceptively simple yet profoundly impactful as the asymmetry of gains and losses. It is a principle that plays a central role in everything from personal investing and trading behavior to corporate finance, behavioral economics, and even game design.

But what does it really mean, and why should you care?

Whether you’re a seasoned investor, a startup founder, or someone trying to grow their savings, understanding this principle could be the difference between compounding success and unknowingly digging a financial hole.

What Is the Asymmetry of Gains and Losses?

Let’s start with a simple example.

If you invest $100 and gain 50%, your portfolio grows to $150. But if you then lose 33.33%, you’re back to $100. This isn’t just trivia. It’s a mathematical and psychological law of compounding returns.

The key insight is this:

A percentage gain and an equal percentage loss do not cancel each other out.

Why? Because losses shrink your bottom line profit. The larger the loss, the harder it is to climb back. This is the essence of asymmetry.

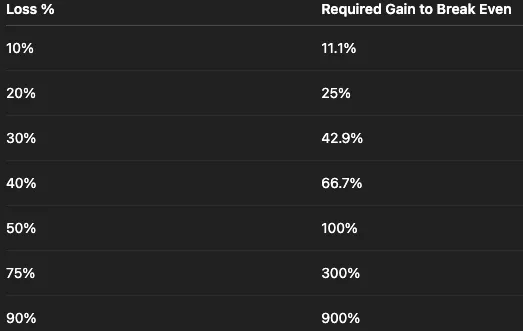

Here’s a breakdown:

The table illustrates how quickly losses escalate into a recovery challenge. The bigger the fall, the more disproportionately large the required gain becomes.

The Historical Foundations: Where Did This Idea Come From?

The roots of this concept go back to the early 20th century with the rise of modern portfolio theory and compounding mathematics. However, it wasn’t until the 1979 work of Daniel Kahneman and Amos Tversky that the psychology of gain and loss asymmetry was given formal academic structure.

Their groundbreaking paper, “Prospect Theory: An Analysis of Decision Under Risk”, changed how we think about rational decision-making.

They discovered that:

People feel the pain of a loss more intensely than the pleasure of an equivalent gain.

This concept, known as loss aversion, is one of the cornerstones of behavioral economics. On average, people require a potential gain that is approximately twice the size of a possible loss in order to take a risk.

Why This Matters for Investors

Losses Hurt More Than Gains Help

If you lose 50% of your portfolio, you must double it just to break even. This is why risk management is crucial. Avoiding catastrophic losses is often more important than chasing outsized gains.

The Math of Recovery

Using the compounding formula: Final Value = Initial × (1 + Gain%) × (1 - Loss%)

You’ll find that even small swings can have a significant impact over time. Many investors chase volatile assets without realizing that the volatility itself erodes returns through asymmetric compounding. This concept ties into something called volatility drag or variance drain. A portfolio with high volatility, even if the average return is positive, may underperform over time because of this asymmetry.

Startups and Burn Rate

If your startup loses 50% of its capital in a few bad decisions, you don’t just need better decisions. You need exponentially better ones to recover. A failed quarter might require two or three record-breaking ones to offset the damage.

Product Design and User Behavior

Game developers and app designers use this principle to create emotional intensity. Losing a streak or a level often feels more devastating than gaining one feels rewarding. This keeps players and users coming back to try to restore what was lost.

How Business Owners Can Protect Their Companies from Loss Asymmetry

Losses in business are not always equal in their consequences. A small hit in revenue may only need a moderate boost to recover, but a large financial loss can require a tremendous amount of growth to get back on track. Here is how to manage your operations and finances with this principle in mind. The goal is to keep more money inside your business, not let it slip away due to avoidable missteps.

1. Address Financial Leaks Early

If your business is losing money, even in small amounts, you cannot afford to ignore it. Unchecked overhead, inefficient systems, underperforming products, or poor receivables management can quickly escalate into major problems. A 20 percent drop in cash reserves might require a 25 percent increase in sales just to get back to your starting point.

What to do: Review expenses on a weekly basis, enforce clear payment terms, and respond quickly when something underperforms. Waiting too long will turn a manageable issue into one that is far more expensive and difficult to fix.

2. Diversify Revenue Streams

Relying on a single product, one client, or one marketing channel exposes your business to unnecessary risk. If that one stream dries up or underperforms, your revenue can collapse in ways that are difficult to recover from using a single adjustment.

What to do: Create multiple sources of income. You might offer advisory services, launch a digital product, introduce maintenance or service contracts, or set up recurring subscriptions. The more diversified your revenue, the more stable your business becomes.

3. Avoid the Profit Mirage Caused by High Volatility

Not all growth is healthy or sustainable. Sharp swings in revenue, high-risk product launches, or erratic cash flow may look impressive on paper, but they often indicate instability. If your margins fluctuate wildly or your customer acquisition costs are unpredictable, your profit is more illusion than reality.

What to do: Prioritize consistency over intensity. A reliable seven percent profit margin is more valuable over time than a ten percent margin that shifts drastically from month to month. Stability compounds in ways that volatility does not.

4. Take Smart Risks, Not Reckless Ones

Every successful business owner takes risks, but the smartest risks are asymmetric. This means the potential upside is significantly greater than the downside. Many entrepreneurs are tempted by risks that feel exciting but do not provide a worthwhile return if they succeed.

What to do: Evaluate your decisions with a clear risk-to-reward ratio. Before investing in new staff, upgrading your location, or launching a marketing campaign, determine the cost of failure and the value of success. Only move forward when the potential reward meaningfully outweighs the potential loss.

5. Avoid Putting the Entire Business at Risk for One Opportunity

Betting everything on a single idea, product, or strategy may work in gambling, but it is rarely effective in business. The more capital, time, or energy you commit to one area, the more vulnerable your company becomes if it fails. Recovering from a full exposure failure can take years.

What to do: Always maintain the ability to pivot. Build and preserve financial buffers, protect your cash flow, and avoid overextending your staff or resources. Long-term business success comes from making sustainable moves, not from taking every possible shot.

The asymmetry of gains and losses is not just a mathematical concept. It is a guiding principle for decision-making, financial strategy, and long-term planning. When you protect yourself against large losses, you give your business room to grow with confidence and flexibility.

As your accountant and advisor, I want to help you build a business that is not only profitable but resilient. If you are ready to review your numbers and explore how to apply this strategy to your specific situation, let’s schedule a conversation.