wHAT WE DO

Entrepreneur Advisors

We are a boutique advisory firm specializing in proactive tax planning and strategic financial guidance for entrepreneurs, business owners, and high-income professionals.

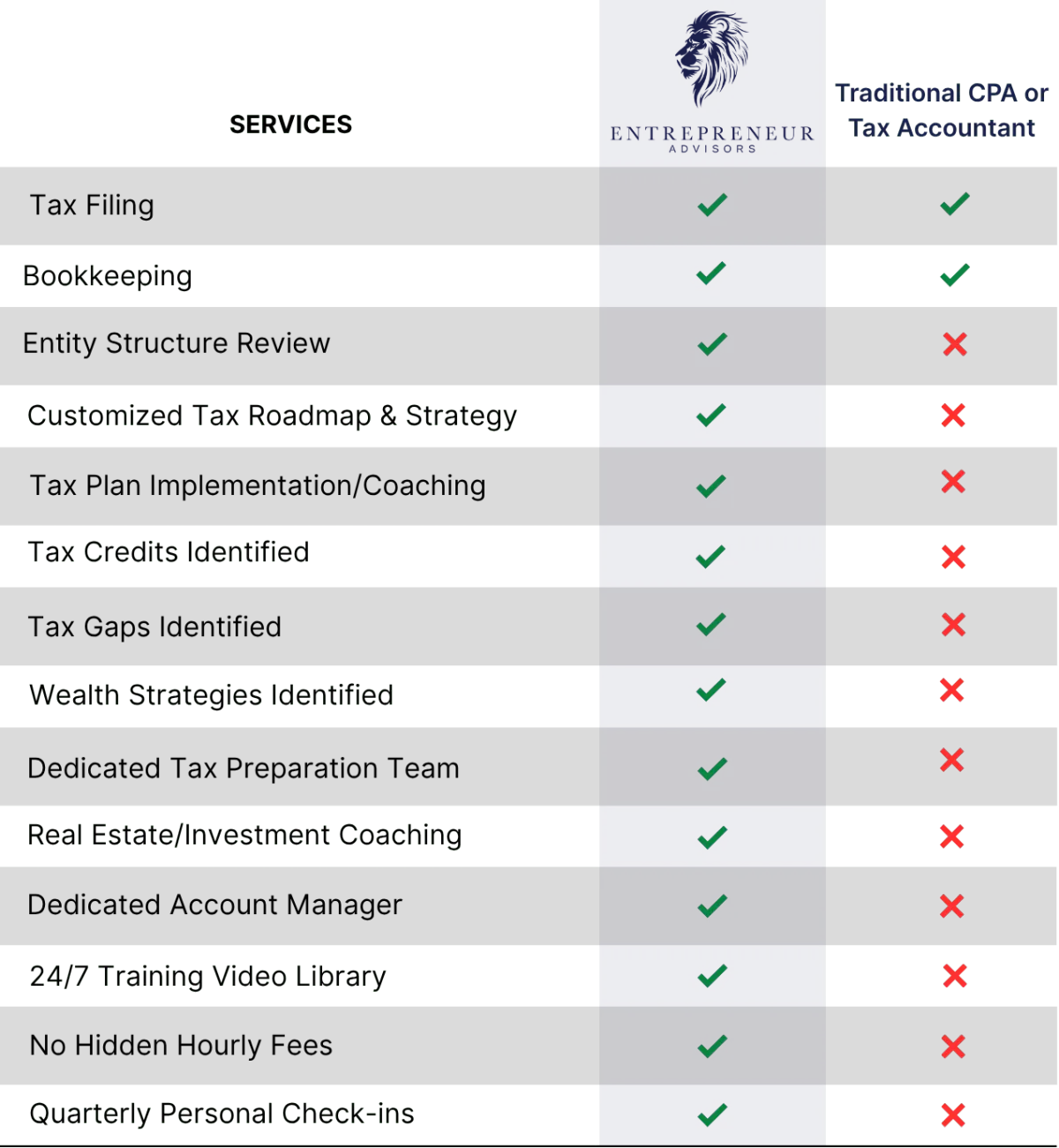

Unlike traditional CPAs or tax preparers who focus only on compliance, Entrepreneur Advisors is built around a forward-thinking model. We help clients understand the challenges and uncover the opportunities unique to their industry.

Clients achieve savings upwards of $73,484 per year. Our services include:

Advisory

Accounting

Audit (Audited and Reviewed Financial Statements)

Experienced Consulting (for Business Sale, Acquisition, and Succession Planning)

Investment Coaching

Proactive Tax Planning and Preparation

Payroll Processing for single-employee S-Corps

Real Estate Specific Tax Credits and Considerations

Tax (Federal, State, Local, and International Tax Compliance)

What we do:

Proactive Tax Planning & Preparation

We do more than tax preparation. We offer strategic clarity. We proactively plan, communicate with precision, and give you the confidence that you are never paying more than your fair share of tax.

While we prepare and file returns with care, our true value lies in the guidance we provide throughout the year. By aligning your financial decisions with your tax strategy in real time, we help you shape your future intentionally, not analyze it after the fact.

Advisory

Our advisory services are built on a clear understanding of what entrepreneurs need from their planning. We offer personal, tailored guidance to ensure your strategies are aligned with your goals and designed to create lasting value.

Most CPA firms focus on filing returns and reducing taxes. While important, that approach leaves opportunity on the table. True advisory means delivering a complete business and tax strategy, built around both near-term wins and long-term wealth creation.

We take a proactive approach. By deeply understanding you and your business, we develop strategies that help you make confident decisions year-round and turn your tax plan into a growth plan.

Cost Segregation and 1031 Exchange

Powerfully accelerate the depreciation on commercial and residential properties. By reclassifying building components and land improvements, you unlock greater deductions earlier, improve cash flow, and reduce your overall tax liability.

When paired with a Section 1031 exchange, you can defer capital gains and strategically reinvest, compounding the long-term tax benefits of your real estate portfolio.

Who we serve

Founders and entrepreneurs of growing small to mid-sized businesses

Professionals with complex income situations (e.g., consultants, agency owners, e-commerce operators)

Clients who feel underserved or overtaxed under traditional CPA models

What sets us apart

We take a proactive approach to tax planning so you can stop overpaying and start building long-term wealth

We quantify your annual tax savings up front so you can see the value before making a commitment

We simplify complex strategies into clear, actionable steps tailored to your business and goals

about our founder

Brian Basinger

Brian Basinger, CPA, is the founder of Entrepreneur Advisors and a leading expert in helping business owners reduce their tax burden and accelerate financial freedom.

Before launching Entrepreneur Advisors, Brian built and led Basinger CPA, a successful accounting firm acquired by a strategic buyer in 2021. Drawing on decades of hands-on experience, he now focuses exclusively on delivering proactive tax strategies for entrepreneurs.

In 2024, Brian published his first book, Bottom Line Profits, which became an Amazon Best Seller. His mission is simple: to give business owners clarity, confidence, and the financial freedom they’ve worked so hard to earn.

Brian Basinger